Entrepreneur | Posted on | Share-Market-Finance

10 Smart Money Habits That Will Make You a Millionaire in 11 Months

0

2828 Views

You can’t make a million overnight (not even in the crypto market). It requires a thorough planning, lot of work and consistency. Ask those rich people, they would give you the same answer. They are rich not necessarily because they work the hardest – but because they are smart enough to pick up right habits that accrue, grow and sustain them money in the most efficient manner.

Now what they do is not rocket science, but it’s not very evident either. After all majority of the population fails to keep up with their footsteps as the path isn’t clearer. But all being said, does that mean you can’t be one of those in the upper echelon?

Well, it depends on your money habit—how you make money, how you spend, where you save and where you invest. In fact, making your first million in and about a year is quite possible if you have picked the right personal finance approach. How?

Here are 10 money habits that will help you reach your financial goal of one million in the quickest way possible:

1.Learn About Personal Finance

The first step in setting the right financial habits is to explore and learn about this niche. So invest your time reading the right books, blogs and watching relevant videos. Start by reading all-time-classic ‘Think and Grow Rich’ by Napoleon Hill. Ramit Sethi’s ‘I Will Teach You To Be Rich’ is a very popular blog; follow it.

Check out this TED talk by Shlomo Benartzi on personal finance -

2. Have multiple sources of income

You cannot become rich if you’re solely relying on your salary or business income. It is imperative that you have multiple sources of income. So aside from your day job, have a part-time gig. Invest in different assets. Rent your empty flat and unused car. Freelance, provide consultancy, pick up any ideal source of income that you can spot. A small contribution from here and there, if sustained long enough, can make a big difference in your bank account.

3.Treat your time as an investment

Time is your biggest asset. It’s also your biggest asset. How you spend most of your time is directly related to how much money you make. If you take the example of any millionaire and billionaire, you will almost always find them super-efficient in managing their time. Because they know, as clichéd as it is, time is really money. So be careful about how you spend your time; avoid committing too much of your time in doing something that isn’t delivering you adequate returns.

4. Set Definite Mini Money Goals

You can’t reach somewhere if you don’t really know where you’re supposed to go. So in order to make your first million, you must set mini goals with definite timelines. Know exactly how much money you will make in the next 1 month and the following months. Outline a plan how you’re going to do that.

5. Review Your Expense Regularly

We’re living in an age where so many of us are impulsive buyers. We spend big money on things that we don’t need. So it is no less than essential that you keep an eye on your spending habit—how, how much and where you’re spending your money the most. Review your expense every week, if doing it daily is not possible. Keep a check on where your money is going, and then stop the unnecessary leakages.

Read Also :-Billionaire who made most money in one day

6. NEVER fail to pay bills on time

Failing to pay your bills on time is the biggest budget blunder you can make. So always pay your rents, bills, and other essential expense on time without failing. And if you have to too many payments to make every month, you’re better off automating this entire proves. There are applications out there that can time your payments every month from your account, without you worrying about paying your dues.

7.Don’t save, make your money work

Even till this day, many of us prefer saving our money in our lockers. Some save their money in a savings account and settle for the meager interest rate. If this sounds something like you then stop right away. The biggest mistake you can make with your money is to let it stay somewhere without growing in sufficient proportion. To be rich, it’s important that you let your money work and grow. So start investing in stocks, bonds, mutual funds, real estate and other assets and avenues.

8.Surround yourself with smart minds

You’re an average of the 5 people you spend the most time with. So if you’re spending your time with people who are not monetarily efficient, don’t have a proper financial plan and spend extravagantly, you will eventually turn up to be like them. So, while this piece of the tip isn’t quite common, it’s very relevant. Surround yourself with smart minds. Attend conferences and seminars, follow self-made millionaires online, and communicate with them in any way possible. To make your first million, you need to be motivated and inspired.

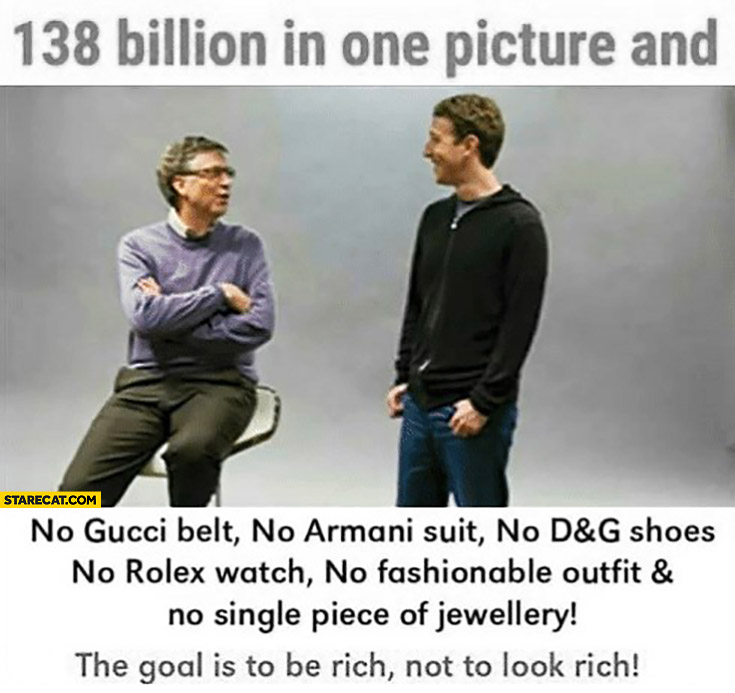

9. Stop showing off

Do you really need to order such extravagant food whose name you cannot even pronounce? Or do you really require that expensive clothe and bag? One of the biggest flaws of today’s millennial is believing that showing off is a social validation to success. If you too spend too much of your money (and time) in showing off, you’re harming your own-self. STOP. NOW. Realize your limited needs and stop getting influenced by the extravaganza and pretense of other people.

10.Think about money every day

If you want to get something, you must invest your time in thinking about it. You must stimulate that dream until that dream becomes a reality. So think about your monetary goal all the time, think how you’re going to achieve it and, most importantly, think about how you’re going to sustain it. The more you think about it, the closer you will feel towards it.

These are 10 smart money habits that can (and will, if executed well) help you get your first million in as less as 1 year. Remember, becoming rich isn’t difficult—and it shouldn’t be your goal in the first place. Your goal must be to make enough wealth to adequately sustain your own life, as well as your family’s, and additionally, give a portion of it to charities.