Software Developer | Posted on |

Financial Inclusion- A Step towards Economic Equality

0

550 Views

Economic equality is a very important building block in the formation of a truly democratic nation,as it distinctly supplements to social and political equality as well.

The need to refine this unit was deeply felt as even after 67 years of independence,less than 2/3rd of Indian people had access to the banking sector.

A major step in this direction was taken by launching the Pradhan Mantri Jan Dhan Yojana in August,2014 with an objective of ensuring various financial services like availability of basic savings account,credit facility along with insurance cover to the excluded sections of society.

Many other schemes such as StandUp India, Pradhan Mantri Mudra Yojana etc were also launched with the similar objective of Financial Inclusion of various sections of society.

We'll have an overview of what these schemes offer:

As given in the PMJDY Mission Document,

by Ministry Of Finance ;

The scheme was launched based upon the following 6 pillars:

1. Universal access to banking services – Branch and Banking Correspondants.

2. Basic savings bank accounts with overdraft facility of Rs. 10,000/- to every household

3. Financial Literacy Program– Promoting savings, use of ATMs, getting ready for credit, availing insurance and pensions, using basic mobile phones for banking

4. Creation of Credit Guarantee Fund – To provide banks some guarantee against defaults

5.Insurance – Accident cover up to Rs. 1,00,000 (enhanced to 2,00,000 after 2018) and life cover of Rs. 30,000 on account opened between 15 Aug 2014 to 31 January 2015

6. Pension scheme for Unorganized sector

This scheme not only helped in achieving economic equality,but also aimed at enhancing financial inclusion by improving the penetration level of the banking sector in India.

It reaffirms our faith to the central principle of 'Sab ka Sath Sab ka Vikas'.

Today, after 6 years of implementation of the scheme,some of its major achievements are:

1. As recognised by Guinness World Records, the most bank accounts opened in 1 week as a part of financial inclusion campaign is 18,096,130 and was achieved by Dept. Of Financial Services,Govt of India from 23-29 Aug 2014.

2. Increased usage of Rupay cards.

3. Continuous increase in % of operative accounts.

4. 'Jan Dhan Darshak' app launched to provide citizen centric platforms for locating banking touchpoints in the country .

5. Total of 30,705 Cr have been credited in accounts of women PMJDY account holders during apr-june 2020 under PM Garib Kalyan Yojana.

However, the road was not that smooth for the implementation of this scheme.

Some of the challenges that it still faces are:

1. Generated Lower revenue ; therefore perceived as not being cost effective.

2. Opening of Duplicate accounts.

3. Increase in Dormant accounts

4. Overdraft facility turning into substandard assets or NPA.

5. Lack of Infrastructure in rural areas.

As the scheme is a success in many terms, the government too is looking for methods to augment its performance.

Some of the ways to ameliorate the scheme are :

1. Endeavour to ensure coverage of PMJDY account holders under micro insurance schemes.

2. Promotion of digital payments including RuPay debit card usage amongst PMJDY accountholders through creation of acceptance infrastructure across India

3. Improving access of PMJDY account holders to Micro-credit and micro investment such as flexi-recurring deposit etc.

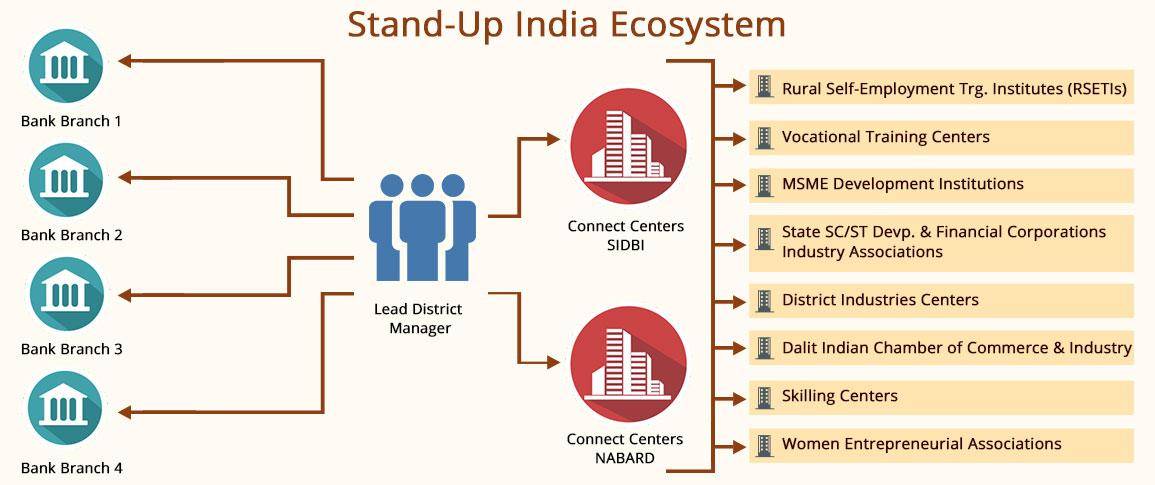

Stand up India Scheme:

This scheme was launched in April,2016 with an objective to provide loans to women and SC/ST entreprenuers.

Details of the scheme are:

1. The loan provided under this scheme includes a term loan and the working capital.

2. This scheme will be provided by all Scheduled commercial bank branches.

3. The loans provided under this scheme will range between the amounts of Rs 10 lakh and up to Rs 1 crore.

4. The interest rate however must not exceed the Tenor premium + 3% + MCLR.

5. Loans under the scheme is available for only green field project. Green field signifies, in this context, the first time venture of the beneficiary in the manufacturing or services or trading sector.

Benefits of the scheme are:

1. The objective of the initiative is to provide encourage and motivate new entrepreneurs

2. It can create a very positive impact in terms of job creation, leading to socio-economic empowerment of Dalits, tribals and women.

3. With access to bank accounts and technological education, it will lead to financial and social inclusion.

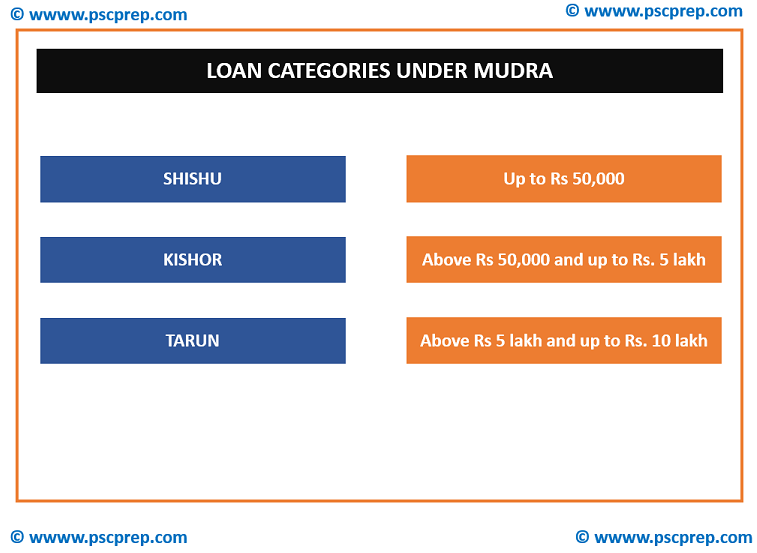

Pradhan Mantri Mudra Yojana:

It was launched in April 2016 with an objective to enable Micro finance institutions(MFI) , NBFC, other co operative banks etc to provide loans to eligible strata of people.

The loans are basically for people having a business plan in aNon Farming Sectorwithactivitieslike the following:

1. Manufacturing

2. Trade and Processing

3. Service sector

The objectives of the scheme are:

1. To sanction loans up to rupees 10 Lakhs to thosewho have a business plan to generate income from a non-farm activity like manufacturing, processing, trading, or service sector but don’t have enough capital to invest.

2. With the help of MUDRA bank, the network of microfinance institutions will be monitored.

3. It will help India also grow its tax base also.

As we can see that the basic objective of financial inclusion in the country is to provide bank accounts, low cost credit , insurance facilities and financial advisory services, but there are also some hurdles we are facing in achieving this, they are:

1. Non availability of banks in many places.

2. Digital Divide in the country.

3. Informal and Cash Dominated Economy.

4. Improper implementation of the schemes.

5. Gender gap.

6. Lack of credit penetration in the country.

For the success of financial inclusion in our country, there has to be a multidimensional approach through which existing digital platforms, infrastructure, human resources, and policy frameworks are strengthened and new technological innovations should be promoted as they are not a luxury anymore, they are the need of the hour and

as correctly said by the Hon'ble Prime Minister of our Country , Shri Narendra Modi ,

" Economic resources of the country should be utilised for the well being of the poor.

The change will commence from this point."

These schemes are a bold and important step in this regard while keeping the central theme of financial inclusion in the prospectus of

development of the nation.