New York Stock Exchange (NYSE) is the largest stock exchange in the world. This, alone, marks it out as a decision-maker and more composite on the global scale—very different from others. Even a slight market movement here can cascade to affect small exchanges across the world.

However, aside from what’s evident, there are plenty more differences, as well as similarities, between the US and Indian stock exchanges. But let’s establish the basics first.

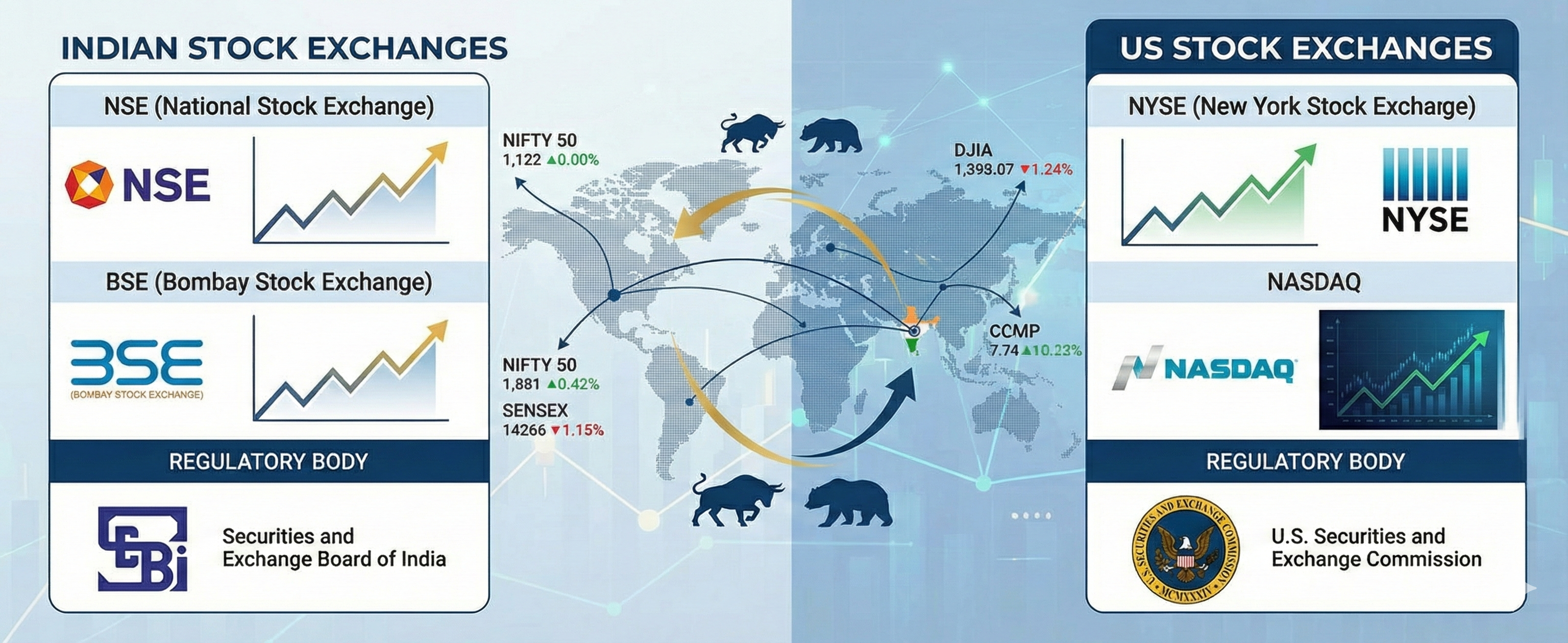

There are 2 stock exchanges in India:

(1) National Stock Exchange [NSE]; [BSE].

(2) Bombay Stock Exchange

In the USA, there are 2 major stock exchanges:

(1) New York Stock Exchange [NYSE];

(2) NASDAQ Stock Exchange.

Combined, the number of companies listed on US stock exchanges is more than 10,000. However, when talking individually, Bombay Stock Exchange has the highest number of listed companies in the world, with an estimate of about 5,690 listings. For NSE, the number is more than 1,600.

NYSE and BSE both share a rich history of growing and facilitating the trading of different security to a diverse group of investors; one came into existence in 1817, the latter one was founded in 1875. Indian exchanges are regulated by SEBI (Security and Exchange Board of India), while the exchanges in the USA are overlooked by SEC (Securities and Exchange Commission). The indices for NYSE are Dow Jones, NASDAQ, S&P 500 and NYSE Composite. For NSE, it’s Sensex, Nifty, and Nifty Junior.

These are few of the fundamental differences between the stock exchanges in India and USA. Them being addressed, from a professional point of view one can easily say that NYSE is much more mature and organized as compared to its counterparts in India. Their operations and functioning are quite complex, depending on an awful lot of factors. Also, when it comes to trade execution, thanks to technology advancement in the country, US Stock Exchanges are quick and efficient.

On the other hands, NSE – and even BSE – is much immature on every stage, still getting better and adapting to improved mechanisms.

But here’s the biggest difference that puts NYSE above NSE on every front. In the USA, the stock market includes 40-50 percent retail participation. It also includes many foreign investors. This makes it extremely volatile. Meaning, even a small movement can affect the final consumers, as well as foreign investors, and hence their respective countries.

However, in India, the scenario is quite different, with very less market participation of the retail players. Here we have a large number of Foreign Institutional Investors. And these players, making up a backbone for Indian stock market, can also play an influencing role. Say, for some reason, the USA stock market becomes more appealing than India’s. These FIIs would unsurprisingly pull their money from Indian stock market and put it where it’s more profitable.

Why do you think we keep a keen eye on the FED rate? Because an unfavorable change in the interest rate can cause a knee-jerk reaction among foreign investors, which can affect the local market! And this is the exact same reason why and how US events spiral on to the global scene, ultimately impacting a large number of countries collectively.

In short, in a not-so-subtle way, American Stock Exchanges are like puppet-masters, with other stock exchanges in the world, including India’s, dancing on its tunes.

These are few ways how Indian and US’s Stock Exchanges differ and matches. While they are supposed to do the same thing, one certainly enjoys more power and control on the global scene than the others.