Marketing Manager | Posted on | others

The Pro Way Of Finding A Credit Card Payment Processor

0

156 Views

In today's world, most businesses accept payments in digital form. There are various advantages of accepting credit and debit card payments. Modern payment instruments help business owners get cash flow quickly and at a low cost.

Certainly, there are many benefits of joining hands with a payment processor; however, your payment provider may make a hole in your pocket if not chosen wisely.

This detailed article will look at the payment industry concerning merchants. It will help you find the right payment processor for your business by looking at various elements.

CNP OR Ecomm. Choose Wisely Transact Well.(H2)

Even in 2022, not all businesses work online and offline. Many businesses still operate on the retail model. A smaller fraction accepts payment online through the website and mobile apps. And even smaller share is of merchants who use both modes.

So the most important thing is to identify which payment mode is best suited for your business. If your business is web-based, you need an online credit card processor (CNP Card Not Present). If your business is retail and involves face-to-face interaction with customers, you need a retail card processing solution (Card Present Payments).

Remember that very few providers offer both CNP and card-present payments. Mostly they specialize in either of the modes. It would help if you worked with a payment processor specializing in your business's mode.

Popular Pricing Structures In The Payment Industry

Many merchants do not know how pricing works in the payments industry. One processor may charge 3%, and the other may charge 2.9%. It may not be very clear at times. So a business owner needs to identify the rules of pricing card transactions.

In the payment processing industry, there are three types of pricing structures.

Fixed Pricing.In this pricing model, the processor will charge a fixed percentage on each transaction, no matter the value of the transaction.

Tiered pricing.It is also called the step-by-step pricing model. This model is usually given to merchants who progressively plan to increase monthly sales volume. If the merchant achieves a bigger target, the processor reduces the rate per the agreement. If the merchant does not achieve the agreed projection, the processor increases the rate per the agreement. In a nutshell, higher sales volume may help merchants pay fewer fees.

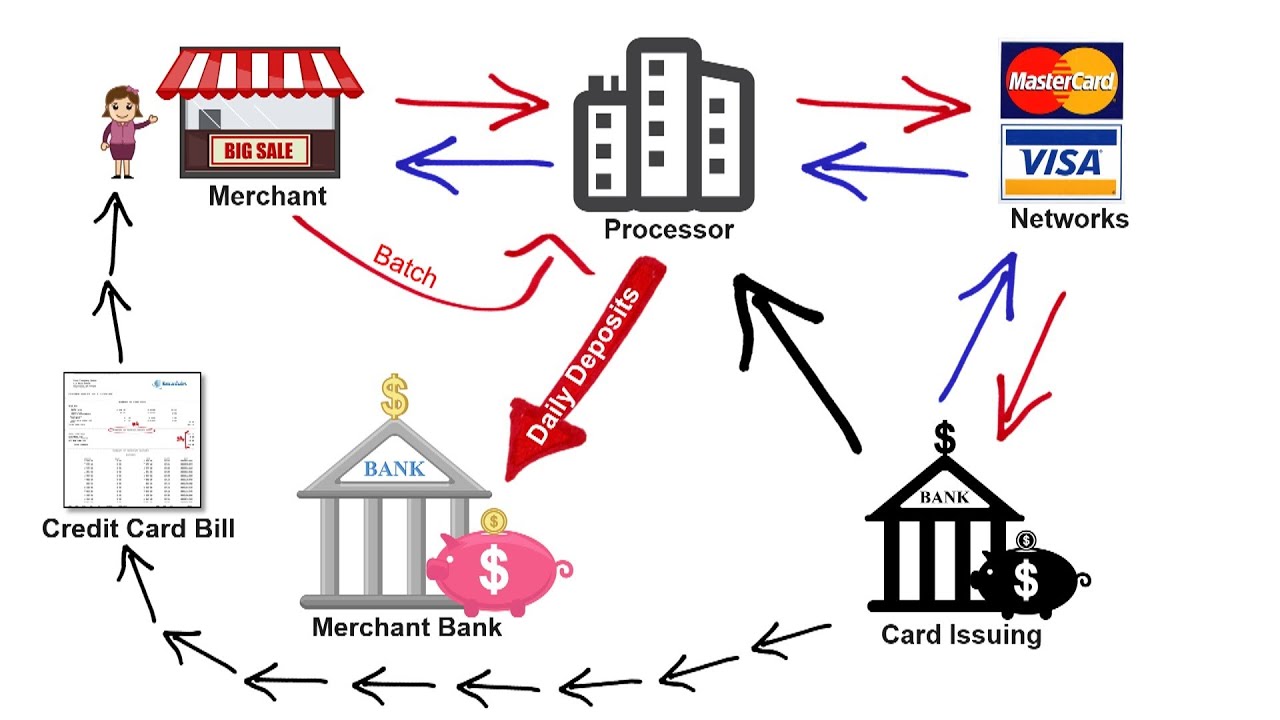

Interchange-plus-plus pricing.Every credit and debit card brand has a fixed transaction fee on its card type. The fixed fee of the car brand varies depending on various factors, including whether it is a debit card, credit card, prepaid card, or virtual card. The processing company fixes a specific percentage charged on the Interchange fee. The interchange ++ model involves the fee of three parties.

Interchange is the card issuer fee. It goes to the bank that has issued the card.

- The first plus is the card scheme fee. It goes to the card brand. Example Visa, Mastercard, and JCB

- The second plus is the acquirer fee. It goes to the payment processing company.

- Not Every Processor Is Global. Ensure It is A Multi-Currency Gateway.

Other features that you must look at include Multi-Currency payment processing. As a business owner, you may be getting sales from customers in different countries. If your credit card processor does not allow you to accept payments from other nations, you may be missing a lot on profits.

Ensure that your payment processor allows you to accept multiple currencies on your website. The payment industry uses DCC, also known as dynamic currency conversion. The DCC technology intelligently converts the product's pricing into the user's home currency. It increases trust and reduces the cart abandonment ratio.

Digital Payments Come With Risk. You Need Defense Tools In Place.

- 3D secure processing adds the second level of authentication when the transaction happens. This fraud filter reduces the risk of fake transactions. The transaction does not go until the card user verifies by submitting a one-time password.

- AVS Address Verification System helps business owners reduce the risk of accepting fake orders, thus reducing financial losses. The system automatically checks if the user's address matches the one on the card account.

With thousands of payment processors and everyone claiming to offer unique features, it can sometimes be tough to choose the right one. However, the above factors can certainly help you zero in on a few of the best providers for you.

Bankim Chandra is a fintech professional and loves to write about thepayments industry.