Marketing Manager | Posted on | Education

WHY ARE MUTUAL FUNDS IN INDIA A GOOD INVESTING OPTION?

0

2913 Views

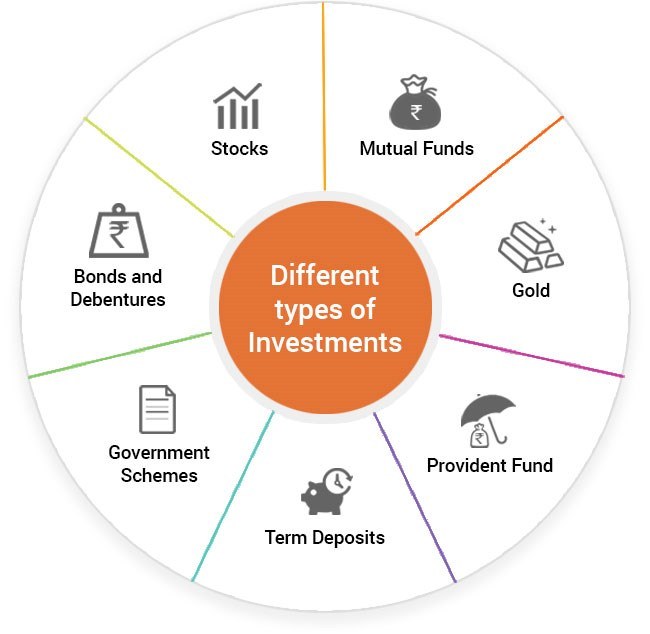

Mutual funds in India are a popular investment option for individuals looking to invest in the stock market or other financial instruments. A mutual fund is a professionally managed investment scheme that pools money from multiple investors and invests in a diversified portfolio of stocks, bonds, and other securities.

Investors can choose from various types of mutual funds in India, including equity funds, debt funds, balanced funds, tax-saving funds, and index funds, among others. Each type of fund has its investment objective and risk profile.

Investors can invest in mutual funds in India through various channels, including online platforms, mobile apps, and traditional channels like banks and financial advisors. It is essential to understand the risks associated with mutual fund investments and to choose a fund that aligns with your investment objectives and risk tolerance. It is also important to regularly monitor your investments and review your portfolio to ensure that it remains in line with your investment goals. There are several reasons why mutual funds in India are a popular investment option for individuals:

- Professional management: Mutual funds in India are managed by experienced fund managers who have expertise in stock selection and portfolio management. These professionals analyze market trends, identify investment opportunities, and manage the fund's portfolio to achieve the investment objective.

- Diversification: Mutual funds in India offer investors access to a diversified portfolio of securities. This diversification helps to spread the risk across multiple securities and asset classes, which can help to mitigate the risk of loss.

- Affordability: Mutual funds in India can be an affordable investment option for retail investors. Investors can start investing in mutual funds with as little as possible and can invest small amounts regularly through systematic investment plans (SIPs).

- Tax benefits: Some mutual funds in India. offer tax benefits under Section 80C of the Income Tax Act. Investors can claim a deduction of up to Rs. 1.5 lakh (approximately $2,000) from their taxable income by investing in ELSS.

- Liquidity: Mutual funds in India offer high liquidity, which means that investors can easily buy and sell their mutual fund units at any time. This liquidity makes mutual funds a suitable investment option for individuals who may need to access their funds in the short term.

- Transparency: Mutual funds in India are regulated by the Securities and Exchange Board of India (SEBI), which requires mutual fund companies to disclose information about their investments, fees, and performance to investors. This transparency helps investors to make informed decisions about their investments.

In conclusion, mutual funds in India are a popular investment option for individuals due to their professional management, diversification, affordability, tax benefits, liquidity, transparency, convenience, flexibility, low cost, and historical performance. However, investors need to choose mutual funds that align with their investment goals and risk tolerance and monitor their investments regularly. NFO or New Fund Offer is a term used to describe a new mutual fund scheme being offered to the public. It is an opportunity for investors to invest in a new fund at its initial offering price. At 5paisa Investors can choose from a wide range of mutual funds in India, including large-cap funds, mid-cap funds, small-cap funds, debt funds, balanced funds, tax-saving funds, and index funds, among others.