Financial analyst (Mudra finance company) | Posted on | Share-Market-Finance

What is Project Sashakt and how are banks planning to deal with NPAs?

Entrepreneur | Posted on

According to a report on Quartz, 14 of 21 state-run banks in India has suffered a total loss of Rs 42,043 crore. (Source) And the gross NPA of public sector banks stood at Rs 7.77 lakh crore by the end of December 2017. (Source)

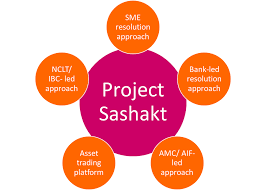

Keeping this situation in mind and few other problems, the introduction of Project Sashakt is a much welcome move. Basically, a committee of bankers, led by the Chairman of Punjab National Bank Sunil Mehta, submitted a report on ways to deal with Non-Performing Assets. Interim Finance Minister Piyush Goyal, on Monday, announced that the government has accepted and approved this report. And they would be moving ahead to implement the actions mapped in the report.

0

0 Comment

| Posted on

A group led by PNB chairman Sunil Mehta suggested Project Sashakt to assist consolidate stressed assets. Up to 50 crore in bad loans would be managed at the bank level, with a 90-day deadline. In recent years, the Indian banking system has seen a sharp rise in non-performing assets. This is largely attributed to the slowdown in economic growth, reduction in policy rates and government measures undertaken to tackle rising bad loans. Amongst other measures, banks have been asked by the Centre to identify stressed assets and provide for adequate provisioning during their financial year 2016-17 financial accounts. The Reserve Bank of India also mandated that at least 40% of total restructured loans should be made IRDA (Insurance Regulatory Development Authority) compliant by mandating coverage for these products from life insurers.

0

0 Comment