Net Demand and Time Liability (NDTL) is a term used in banking and refers to the total amount of money that a bank's customers have deposited with the bank, minus the amount of money the bank has lent out to borrowers.

In other words, NDTL represents the total funds that a bank has available to meet the withdrawal requests of its customers. This includes the total of all types of deposits, such as savings deposits, current account deposits, fixed deposits, and other types of deposits held by the bank.

On the other hand, Time Liability refers to the deposits that are held by the bank for a specific period, such as fixed deposits. The bank has to pay interest on these deposits to the depositors, and the bank can only use these funds after the specific time period expires.

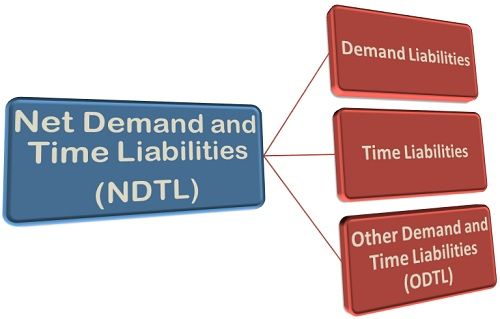

So, NDTL is the sum of demand deposits (which can be withdrawn at any time) and time liabilities, whereas time liabilities refer only to those deposits that cannot be withdrawn before the expiry of a specific time period.