Cashier ( Kotak Mahindra Bank ) | Posted on | Share-Market-Finance

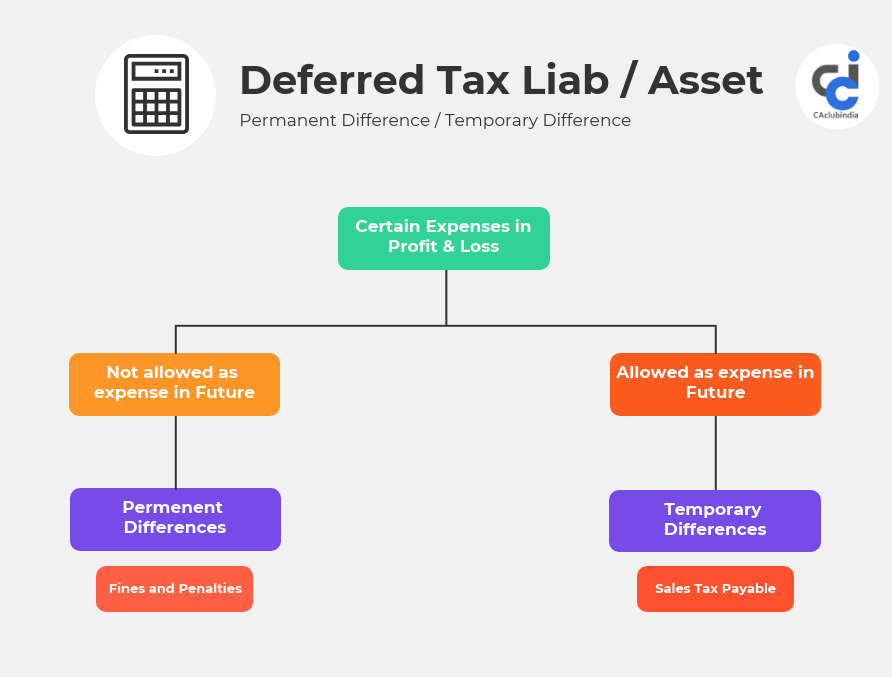

What is a Deferred Tax Liability and what is its purpose?

What is a Deferred Tax Liability

A deferred tax liability is a tax that is assessed or is due for the current period but has not yet been paid.The deferral comes from the difference in timing between when the tax is accrued and when the tax is paid.A deferred tax liability records the fact the company will, in the future, pay moreincome taxbecause of a transaction that took place during the current period, such as aninstallment sale receivable.

0

0 Comment

0

0 Comment

The tax assessed or it is due for the current period and has not been paid yet, then it is known as Deferred Tax Liability. The difference in the timing when the tax is paid and is accrued is the time from which the deferral comes. It commonly arises in depreciating fixed assets, recognizing revenues and during the valuation of inventories.

The deferred tax liability also tells us how much more tax company has to pay in future because of the present transactions.

Reasons why deferred tax liabilities occur are:

I. Accounting of figures more than once.

II. Companies aiming only towards showing increased profits in order to increase the shareholders for their company.

III. Companies also follow the technique to increase the current profits in order to reduce the tax burden.

0

0 Comment