Digital Marketing Manager | Posted on | Share-Market-Finance

Can I get a small business loan with bad credit?

Finance | Posted on

0

0 Comment

financial Advisers | Posted on

yes, you can get a small business loan with bad credit

These following steps will help you

1. Search for the Lender

0

0 Comment

Employee | Posted on

0

0 Comment

Project Manager at The Economic Times | Posted on

Loan is not supposed to be given to somebody who cannot give it back. Bad credit score indicates that you have been a defaulter in the past, therefore it’s not very easy to get a loan from banks.

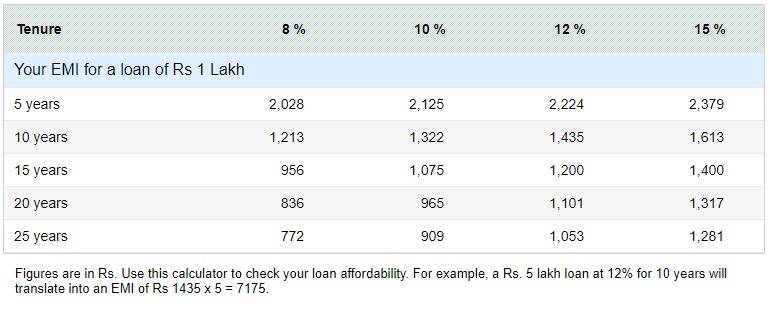

Everybody loves a cheaper loan. But, there are no fixed interest rates for unsecured loans. The rates vary according to the borrower’s ability to repay and his credit profile.

Loan is a one of the major businesses for lenders, hence they can take risk. But there are some institutions who are willing to disburse small amount of loan to anybody basis on your ability to repay.

CIBIL data says 80 per cent of the loans that get approved have a score above 750.However, credit score is not the only parameter which lenders look at for approval and deciding the interest rates.

The difference in the interest rate paid by someone will vary depending on the product (secured or unsecured loan), size of the credit and the payback tenure. The difference will be bigger in case of unsecured loans than secured loans.

It is important note here that a person with no credit history will be treated differently from a person with credits defaults as the reason of poor score.

If your score is low because of default then chances of getting a loan is lower. But if the score is low because of less amount of loan taken or because credit history is relatively recent then you can still get the loan.

Where to go for loans with poor credit scores?

NBFC: Typically, non-banking financial Institutions (NBFCs) are more flexible with credit scores and the cut-offs than banks. NBFCs have disbursed loans for a credit score as low as 360.

P2P: Peer-to-peer (P2P) is a crowd-funding model, which is largely online. This is a platform where people invest their money with people who want to borrow without any interference of any financial institution.

P2P loans are catching the attention across metros. Easy and quick disbursements are not the only drawing points for P2P companies. The rate of interest offered on the online lending platform is another major draw.

0

0 Comment