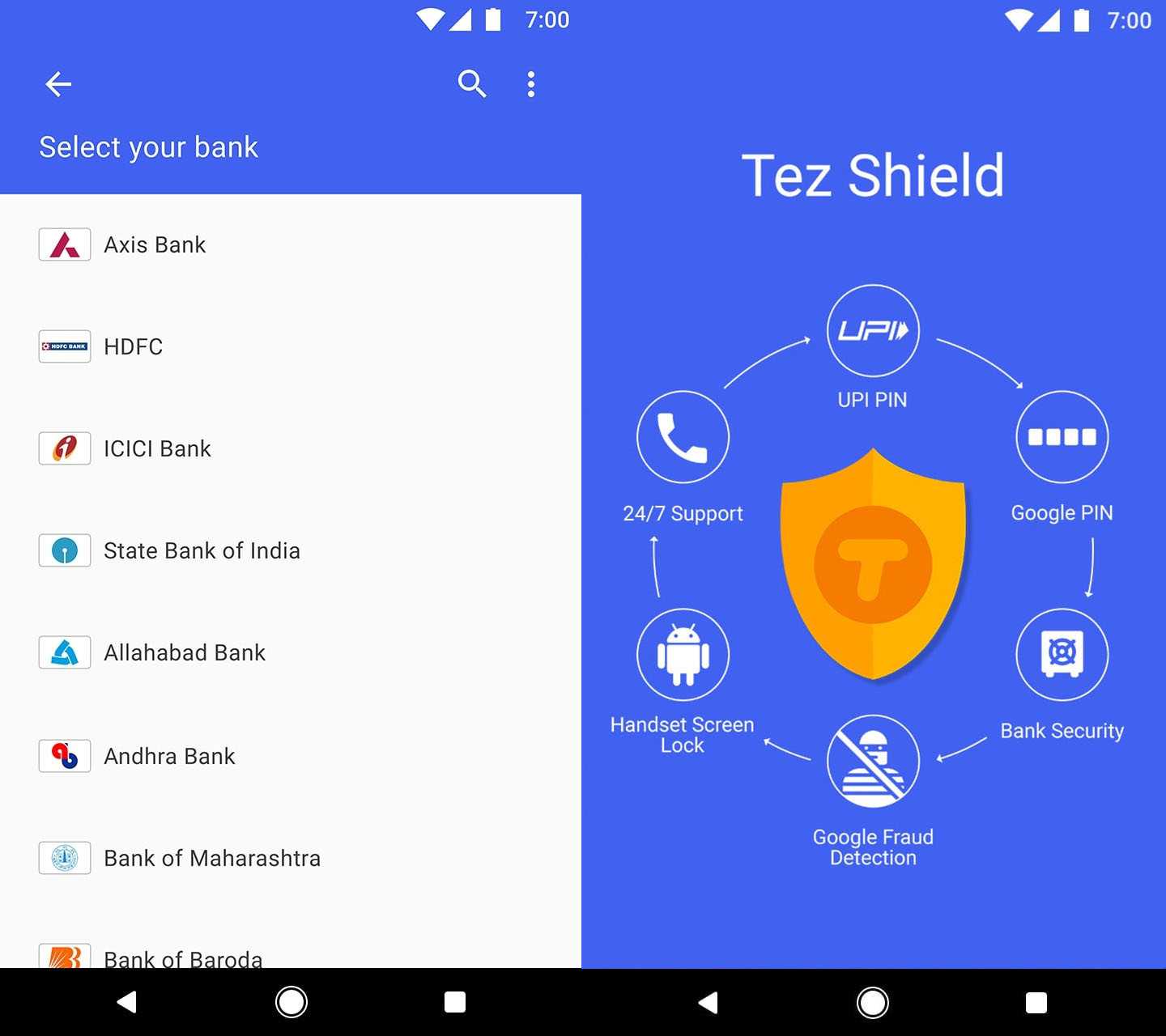

Tez was launched by Google in September last year. And after one year, Google has rebranded it as Google Pay, announcing the partnership HDFC Bank, ICICI Bank, Federal Bank and Kotak Mahindra Bank. The partnership is being initiated for the pre-approved loans.

Google pay gives its users the option of exchanging money directly from their accounts, and also makes peer to peer transactions possible. This feature of Google pay makes it different from Paytm and E wallets.

On android play store, Google Tez has crossed 50 million downloads. Other features of Google Tez:

• It has an audio based QR system. So Google Tez, like Chirp, uses ultrasonic waves to transfer money. With the help of ultrasonic waves, Google pay creates a one-time password for the payments.

• Above, I told you how Google Tez is different from Paytm. But one similarity that Tez and Paytm have is incentives. Tez offers its users as many cashbacks as Paytm itself. It has schemes like “Lucky Fridays” where you can win cash prizes by sending Rs.500.

• Google Tez also helps you in paying utility bills like those of electricity, gas, water, insurance, mobile, landline, etc. According to Hindustan Times, “currently, the application supports payments to services like redBus, Zerodha, TataSky, BESCOM, and Goibibo”.

• Tez shows you the list of contacts whom you can send money or request money from. It also shows you transaction history.

On android play store, Google Tez has crossed 50 million downloads. Other features of Google Tez:

On android play store, Google Tez has crossed 50 million downloads. Other features of Google Tez: